Your Trusted Partner

We Can Help

- Tax Attorney Help

- Un-Filled Tax Returns

- Wage Garnishment

- 941 Payroll Tax Debt

- State Tax Debt

- Bank Levy

- Audit Defense

- Offer in Compromise

- IRS Notices

- Offshore Banking

- IRS High Dollar Unit

- Estate Taxes

Estate Taxes

Have you recently lost a loved one who left you a large inheritance?

Did you know that depending on the year and the amount inherited, the IRS can tax you up to 45% of the Estate’s value on that income? Have you already liquidated half of the Estate just to pay off the taxes? Fast IRS Help Estate can help! Our staff of tax professionals has over 20 years of experience in disputing Estate and Gift tax values to the IRS to bring the overall estimated value down.

Lower overall estimated Estate and Gift tax values result in significantly lower tax liabilities. In some cases, the professionals at Fast IRS Help Estate have been able to argue an Estate and Gift tax’s value as being under the tax threshold, therefore finding the taxpayer responsible for no liability at all.

Losing a loved one can prove to be an overwhelming and emotionally draining time. The thought of inheriting the deceased’s estate only amplifies the grief and pain of the loss. In an effort to finding a quick paperwork resolution, many uninformed heirs of large estates needlessly pay the full estimated tax amounts on their inherited assets, resulting in the loss of hundreds and even millions of dollars that otherwise would be theirs.

Our team of tax professionals will fight to preserve your wealth!

Even if you have already paid the taxes, in many cases the Fast IRS Help Estate professionals can negotiate for you to receive money back from the IRS. By going back and disputing the value of the Estate or Gift tax at the time of inheritance, in many cases Fast IRS Help Estate has been able to convince the IRS to refund our clients the difference.

For immediate assistance, call us today at (888) 958-0511 or fill out the free consultation contact form at the top of this page.

IRS High Dollar Unit

If You have a tax liability over $1,000,000 we can help!

Having a tax liability in the millions is not something most taxpayers or businesses will ever have to worry about, but those that do should pay special attention. When the IRS is owed such a large amount, these cases are assigned to their special High Dollar Unit Division. That means that your tax debt and case are under the microscope as extremely high visibility issues, and your assets and income are in danger of being seized.

Because of the recent economic events, and because so many high net worth individuals and businesses came under fire and fell into extreme tax debt as their incomes plummeted, Fast IRS Help has dedicated an entire division just to handle these types of cases, and are one of the few firms in the country that handle tax liabilities this high.

Our tax attorneys and tax professionals are highly skilled in rolling up their sleeves and defending your rights, and will work with the assigned revenue agents to mediate these cases successfully.That means wage garnishments, bank levies, and asset seizures can be avoided by working through our specially trained representation, and the stress and fear of losing a business, an account, or a valuable asset to seizure can be muted.

For immediate assistance, call us today at (888) 958-0511 or fill out the free consultation contact form at the top of this page.

Your high dollar case is important to us, and we understand the consequences that having a liability this high can bring. Our professional team has many years of experience in negotiating with this special division of the IRS, and we understand how to enforce every possible tax relief code that is available to the taxpayer who is suffering from a massive liability.

Rest assured. We will provide the highest level of representation available, and will protect your assets and mediate your case aggressively.

Offshore Banking

If you have undisclosed foreign bank accounts, you face possible criminal charges and punishing penalties. Only an attorney can represent you!

The IRS began it’s Offshore Voluntary Disclosure Initiative in 2009 to force taxpayers and offshore banks to disclose all accounts exceeding ten thousand dollars or face criminal charges and massive civil penalties. Due to it’s success, they have leaned on it heavily in recent years as one of the most powerful ways to collect the billions of dollars hiding in overseas accounts.

Rules for coming forward with an unreported offshore bank account are very clear: only an attorney can represent you! As this program is relatively new, and incredibly complex, it requires a deep understanding of the process to yield strong results and protect the taxpayer. With a strong defense, those with unreported foreign bank accounts can:

- Avoid prosecution

- Lower penalty rates

- Limit exposure to civil penalties

- Become compliant

- Avoid disclosing your offshore financial institution

- Resolve your case and avoid further examination

- Apply at anytime

Those wishing to comply may do so at anytime–there is no deadline. However, the IRS could decide to end the three-year-old program entirely at any point, so it is important to act now and bring closure to the process. Applying also requires that you have elected an Attorney to represent you. Hiring a Tax Attorney helps avoid further probing, penalties and prosecution by the IRS. Our partners have helped bring clients in the OVDP back to compliance in order to meet all provisions and settle their tax liability.

FATCA – Foreign Account Tax Compliance Act

The objective of FATCA is the reporting of foreign financial assets; withholding is the cost of not reporting. U.S. individual taxpayers must report information about certain foreign financial accounts and offshore assets on Form 8938 and attach it to their income tax return, if the total asset value exceeds the appropriate reporting threshold. To avoid being withheld upon, a foreign financial institution may register with the IRS, obtain a Global Intermediary Identification Number (GIIN) and report certain information on U.S. accounts to the IRS.

OVDP Attorneys

Our tax partners and attorneys begin the declaration of offshore banking by collecting previous federal income tax returns covered by the OVDP disclosure. They will then amend these returns and report additional income, including the absent or amended FBAR. This immediately suspends liabilities and Title 26 penalties until the process is complete. This time allows your team to reach a settlement with the IRS. Good faith arrangements are then made with the IRS to pay in full any remaining tax, interest, and penalties before reaching a closing agreement.

OVDI Attorneys

As with the 2009 OVDP and 2011 OVDI, the 2012 OVDP brings taxpayers with undisclosed foreign accounts who have evaded tax liabilities in the past to come in compliance with United States tax laws. This program was offered as an incentive for those hoping to reduce their limited civil and financial penalties. It has also proved to be a great way to raise revenue for the IRS. According to the IRS, “the 2012 OVDP has a higher penalty rate than the previous program but offers clear benefits to encourage taxpayers to disclose foreign accounts now rather than risk detection by the IRS and possible criminal prosecution.”

A penalty for failing to disclosing financial offshore transfers, gifts, trusts, interests, returns file the FBAR can be as high as the greater of $100,000 or 50 percent of the total balance of the foreign account per violation.

Get Defended By An Attorney

Offshore and foreign banking issues are becoming more and more complex as the IRS ramps up their efforts to collect this unreported income. By hiring a seasoned tax attorney with experience in these matters you better leverage your rights for a fair and just outcome, while avoiding criminal charges and sky-high penalties.

If you’re in need of fast help with your offshore banking issue, call (888) 958-0511 now for a free consultation or fill out the form at the top of this page.

IRS Notices

Have you received certified mail and letters from the IRS or State?

Getting mail from the IRS or State is an unnerving experience, and is one that will send shudders down most taxpayer’s spines. The fear of being collected on is real, and most people and businesses cannot afford wage garnishments or bank levies crippling their financial footing.

Thankfully our staff of tax attorneys, enrolled agents and tax professionals has spent years understanding the tax resolution process, and can intervene and stop these notices before they get worse. There are several types of IRS notices:

- Reminder Notice – This notice is one of the most important reminders that the IRS sends, and acts as a first warning to taxpayers or businesses with a tax liability issue. It usually comes regular mail, and provides fair warning that the taxes are due and payable, and asks for payment to be made promptly. It will list amount owed and the years involved, plus penalties and interest that have been added to the total.

- Intent to Levy Notice – When reminder notices have gone unpaid, the IRS will send intent to levy notices, which will come certified mail, and usually provide thirty days to pay the amount owed. These are very important letters not to ignore, and if these notices go unpaid, the next step will be a levy on your bank account or assets and/or a wage garnishment.

- Final Notice Intent To Levy – If you have failed to respond to reminder or intent to levy notices, this will be the final notice sent, and normally comes ten days before a wage garnishment, bank levy or asset seizure. If the IRS is not contacted immediately, and repayment terms have not been arranged, the final step will be forfeiture of assets to satisfy the amount owed.

Owing a tax debt is a serious financial issue, and is one that must be approached carefully and tactfully for best results. If you owe the IRS and have been receiving notices of amount owed mail or certified mail, don’t ignore them any longer! Our team will step in and resolve these issues quickly, stopping IRS collections in their tracks and getting you a fresh start.

For more information, call us at (888) 958-0511 for a free consultation, or fill out the form at the top of this page. The Specialists at Fast IRS Help ensure every client the best possible result allowed by law.

Offer in Compromise

Has your tax debt gotten out of hand? Are you looking for a way to reduce it but don’t know where to start?

A reduced tax settlement is closer than you think.

The team at Fast IRS Help has decades of experience in successful tax negotiations with the IRS and State tax agencies. If you’d like to find out if you qualify for a tax settlement, contact our offices today by calling (888) 857-4999 or fill out our Free Consultation form.

An Offer in Compromise (OIC) is an agreement between a taxpayer and the Internal Revenue Service that settles the taxpayer’s tax liabilities for less than the full amount owed. An Offer in Compromise can reduce tax debt. IRS tax settlements are subject to certain terms and conditions.

The IRS may accept an offer in compromise based on three grounds:

”Unable to Pay” – Doubt as to Collectability – Doubt exists that the taxpayer can not ever pay the full amount of tax liability owed within the remainder of the statutory period for collection.

- Example: A taxpayer owes $20,000 for unpaid tax liabilities and agrees that the tax she owes is correct. The taxpayer’s monthly income does not meet her necessary living expenses. She does not own any real property and does not have the ability to fully pay the liability now or through monthly installments.

”Don’t Owe” – Doubt as to Liability – A legitimate doubt exists that the assessed tax liability is correct. Possible reasons to submit a doubt as to liability offer include: (1) the examiner made a mistake interpreting the law, (2) the examiner failed to consider the taxpayer’s evidence or (3) the taxpayer has new evidence.

- Example: The taxpayer was vice president of a corporation from 2004-2005. In 2006, the corporation accrued unpaid payroll taxes and the taxpayer was assessed a trust fund recovery penalty as a responsible party of the corporation. The taxpayer was no longer a corporate officer and had resigned from the corporation on 12/31/2005. Since the taxpayer had resigned prior to the payroll taxes accruing and was not contacted prior to the assessment, there is legitimate doubt that the assessed tax liability is correct.

”Special Circumstances” – Effective Tax Administration – There is no doubt that the tax is correct and there is potential to collect the full amount of the tax owed; however an exceptional circumstance exists that would allow the IRS to consider an OIC. To be eligible for compromise on this basis, a taxpayer must demonstrate that the collection of the tax would create an economic hardship or would be unfair and inequitable.

- Example: Mr. & Mrs. Taxpayer have assets sufficient to satisfy the tax liability and provide full time care and assistance to a dependent child who has a serious long-term illness. It is expected that Mr. and Mrs. Taxpayer will need to use the equity in assets to provide for adequate basic living expenses and medical care for the child. There is no doubt that the tax is correct.

It is very important to know and understand what aspects of a taxpayer’s situation the IRS is looking for when submitting an Offer in Compromise. This is what our company specializes in. A tax settlement can be obtained today by calling us at (888) 958-0511 or by filling out our Free Consultation form for a free and confidential tax analysis.

Our tax professionals stand by their commitment to put you in the best position possible for your situation.

Audit Defense

Fast IRS Help can help with both Personal and Business audits.

Audits are considered one of the most feared forms of collections for a reason. The IRS is given the authority to pour over your financial records, and the results of a poorly defended audit can be considerable.

Typically, when individuals find themselves under examination for a PERSONAL audit, it is the result of them claiming expenses that would normally be reserved for small businesses or the self-employed.

Most PERSONAL tax audits are performed on W2 employees who either claim, or try to claim, business expenses against their income. Whether legitimate or not, writing off expenses in certain categories will throw an automatic Red Flag to the IRS or State and spark an examination. Automobile mileage, home office expenses, tithing, and advertising expenses top the list of Red Flag expenses.

Put the power of the law on your side!

Fast IRS Help represents clients in all stages of an IRS or State Tax Examination. Don’t be fooled! The person who prepared the return should NOT represent the taxpayer in the audit! Fast IRS Help Audit Specialists achieve their success rates from being an outside source.

From that first letter to the final examination result, Fast IRS Help offers streamlined representation that requires little to no communication between clients and the IRS or State.

For more information, call us at (888) 958-0511 for a free consultation, or fill out the form at the top of this page. The Audit Specialists at Fast IRS Help ensure every client the best possible result allowed by law.

Bank Levy

Suffering from an IRS bank levy or asset seizure? We can help!

If you have a personal tax debt or if your business has a liability to either the IRS or State, the IRS will begin sending notices demanding payment. If a taxpayer disregards these demands for payment, the IRS will begin to seize assets to satisfy the debt.

The IRS commonly uses bank levies and asset seizures as a method to collect back taxes from the taxpayer and force their had into willful compliance. It is as easy as the IRS sending a letter to the taxpayer’s bank accompanied with the levy notice stating they will be seizing the taxpayer’s bank account. The bank must freeze all of the taxpayer’s funds and forward them to the IRS. Banks who disregard IRS levies face serious penalties, so all banks follow the IRS instructions regarding levies. The IRS can seize funds from any institution, business or individual that has funds belonging to the taxpayer. For example, the IRS can seize funds from a utility company holding a deposit, an escrow company, an investment company or even a stock broker.

Our legal team will step in fast with immediate protection and relief!

Once targeted for a levy or seizure, undoing these actions takes a strong arm and a delicate hand. The Fast IRS Help legal defense team has extensive experience in successfully negotiating the release of IRS bank levies and asset seizures, protecting taxpayers and businesses and keeping them out of further harm.

Our team of tax professionals have stopped and negotiated many bank levy situations for taxpayers. If you want to stop a bank levy or seek assistance in negotiating a bank levy situation, contact our firm today at (888) 958-0511 or fill out our Free Consultation form for a free confidential tax analysis.

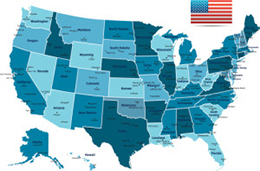

State Tax Debt

State Tax Collection Authorities are usually more aggressive than the IRS when collecting back taxes!

The majority of taxpayers that owe the IRS, typically have a State Tax debt or State Tax issue. State Tax agencies tend to be more aggressive in their collection tactics towards taxpayers that owe back taxes since their economy is smaller and rely on this income to function.That means aggressive wage garnishments and bank levies will begin unless the tax debt is approached skillfully for mediation.

Each State has its own set of guidelines and rules that they follow for collecting on back taxes. Revenue officers are given leeway to collect past taxes at their discretion, and often times the results can mean a small liability can spin out of control quickly. Because of this, It is paramount to hire a company with Enrolled Agents and Attorneys that have experience in the individual State where you have the tax debt.

At Fast IRS Help, our experienced tax professionals can help you resolve your State Tax issue by stopping all collection activity, negotiating a settlement, and setting up an affordable payment plan for you.

If you owe the State back taxes, or you are looking to obtain a settlement on your State Tax debt, contact us today at (888) 958-0511 for a free consultation, or fill out the form at the top of this page.

Our Tax Attorneys and professionals are employed and educated under the laws of each State and have been successful nationwide at enforcing the individual State Tax relief codes that most taxpayers are unaware of. At Fast IRS Help, our success is your success.

941 Payroll Tax Debt

We Can Protect Your Business And Settle Payroll Tax Debt!

Owing 941 payroll tax debt is one of the worst forms of liability issues, since the IRS considers this ‘stealing’ money directly from employees. Left untouched, these issues can spiral out of control, increasing the amount owed through penalties & interest and causing collections such as bank levies and asset seizures.

There are three different scenarios where somebody is responsible for 941 payroll taxes: a self-employed individual, a partnership with employees or a corporation with employees. Employers are required to withhold these payroll taxes from the wages earned by their employees and are required to forward these withholdings to the IRS. A business is required to quarterly file a Form 941, Employer’s Quarterly Federal Tax Return and to annually file a Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return if the business has employees on an active payroll.

The IRS will usually assign a Revenue Officer to collect a payroll tax debt. Revenue Officers will make every attempt to collect the tax debt in full and will not settle for less from the employer. Failure to pay or correct a delinquent payroll tax matter could result in the closure of the business and liquidation of assets.

For more information, call us at (888) 958-0511 for a free consultation, or fill out the form at the top of this page.

Our tax professionals have years of experience and have resolved many 941 payroll tax issues. We assist businesses in reaching a resolution for their past due payroll tax liability by helping them understand their payroll tax obligations. Most importantly, we help the business remain compliant with the IRS tax laws and regulations.

Wage Garnishment

Did the IRS or any state taxing agency issue a Wage Garnishment against your paycheck?

Our company may be able to help you. We have the experience and expertise to negotiate with the IRS and other states throughout the country to release your Wage Garnishment.

Before a Wage Garnishment or Wage Levy is issued, demands for payment of the tax liability to taxpayers are sent. On many occasions, these demands are simply ignored by taxpayers. After these demands for payment are not satisfied by taxpayers, one of the steps taken by the IRS or by the states to effect collection is the issuance of Wage Garnishments.

A Wage Garnishment is a written notice issued by a State’s tax agency or the IRS to a taxpayer’s employer, ordering the employer to withhold a specific portion of the taxpayer’s salary or wage. The instruction by the IRS cannot be ignored by the employer lest that the employer will incur penalties and other potential liabilities to the government. For a self-employed taxpayer, the IRS or the states can garnish the business’ accounts receivables. For seniors receiving social security benefits, certain portion of said benefits can be withheld.

Get fast and immediate relief from your wage garnishment!

For more information about getting a stop to your wage garnishment, call us at (888) 958-0511 for a free consultation, or fill out the form at the top of this page.

Un-Filled Tax Returns

Un-filed Tax Returns Can Cost You Thousands in Penalties!

When you owe the IRS or State back taxes, more than likely it came from not filing your tax returns on time, or filing them incorrectly. The end result is usually a tax debt, and in time, through penalties and interest, it can spiral out of control into something much larger and much more difficult to manage. On average, most tax debt doubles or triples in size before it is resolved!

When you fail to file your tax returns, the IRS goes ahead and files them for you, submitting what’s called an SFR – Substitute for Return. This is generally the worst form of taxation, as it allows for no deductions and the IRS maximizes your tax obligation. On top of that, they will begin to add penalties and interest for failure to file, and if you if you haven’t filed for three or more successive years, then the IRS will heavily pursue collections against you; wage garnishments, bank levies, and asset seizure are on their way.

Get Accurate Tax Return Filing And Stop Collections Fast!

As a nationwide leader in filing overdue and un-filed tax returns, our tax attorneys and specialists understand the intricacies and nuances of these complicated issues, and can get you filed quickly and out of harms way. Some of the returns we specialize in are:

- Individual income tax returns

- Corporation income tax returns

- Partnership income tax returns

- State income tax returns

- FBAR tax returns

- Gift tax returns

Most of the time, your tax obligation and liability can be dramatically reduced with accurate tax preparation, and the threat of IRS collections will be muted.

For more information, call us at (888) 958-0511 for a free consultation, or fill out the form at the top of this page.

Tax Attorney Help

Do you owe the IRS or State more than $10,000?

Are you worried that the constant threats and letters demanding repayment will finally be realized through asset seizure or a wage garnishment? Rest easy. Our team of tax attorneys and professionals are skilled in stopping forced collections in their tracks and getting you a settlement you can afford.

Since each taxpayer’s situation is different, our team takes pride in their vast knowledge and experience in understanding the IRS and State agency codes. Our professional staff know which tax codes to enforce and how to negotiate positive outcomes for our clients. Whether it is negotiating back taxes or just filing your return properly, our tax professionals stand alone in the tax resolution industry. We negotiate your tax debt hard so you don’t have to!

We Negotiate Hard So You Don’t Have To!

Our Tax Attorneys will negotiate hard for the best possible relief that you qualify for, and most of our Enrolled Agents are ex-IRS employees who understand every IRS and State agency code. They know how to communicate this information to our Attorneys who will then negotiate for you.

Along with tax attorneys and enrolled agents, our CPA’s specialize in filing returns to assure a lesser tax liability. Proper planning with tax returns is something that is very important when helping to avoid tax debt down the line. Additionally, our Client Relations Managers handle all the paperwork and phone calls to ensure that your account moves forward properly.

For more information, call us at (888) 958-0511 for a free consultation, or fill out the form at the top of this page.

Our Path To Success

Success Stories

Frequently Asked Questions

Yes! A lot of people think that hiring a local accountant or a friend of a firend to help them is a good thing, until they realize that tax debt is a specialty, and takes years to master it’s intricacies. So even if you’ve already hired someone, and the results have been less than stellar, we can intercede with immediate action to protect your interests and make sure this friend of a friend doesn’t put you in harms way.

Yes! We are specialists at preparing and maintaining accurate tax returns and can prepare personal and business returns. Even if you owe money and haven’t filed in years, by professionally filing old returns your tax debt can be reduced dramatically.

When you start getting mail from the IRS, that generally means you owe them back taxes, and if these notices go ignored, the next step is a form of asset seizuure. This can be a wage garnishment, bank levy, or they can attach homes and property to pay off the liability. It’s very important to get these notices answered quickly and professionaly, otherwise the IRS will seize your assets and your ability to mediate the issue successfully can be compromised dramatically!

This is a question we get all the time, but the short answer is 100% NO! The IRS actually wants to resolve your tax debt and close out a costly collection process, and it relies on companies like us to help taxpayers get compliant. That means that the IRS doesn’t have to pay revenue officers anymore to manage your case, and you get to be tax free!

Let’s Get Started!